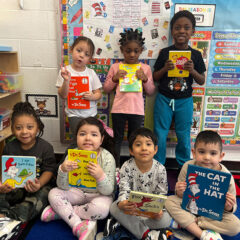

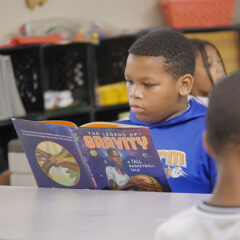

Cornerstone Center for Early Learning: Building a Sustainable Future with YouthBridge

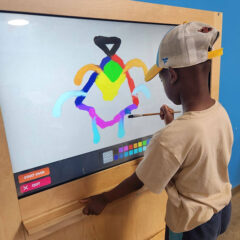

But how does an organization keep this flame burning brightly for generations to come? By teaming up with YouthBridge Community Foundation of Greater St. Louis and launching a YouthBridge Endowment Fund, Cornerstone ensures resources for day-to-day needs, creative programs, unforeseen challenges, and visionary projects.