Cornerstone Center for Early Learning: Building a Sustainable Future with YouthBridge

But how does an organization keep this flame burning brightly for generations to come? By teaming up with YouthBridge Community Foundation of Greater St. Louis and launching a YouthBridge Endowment Fund, Cornerstone ensures resources for day-to-day needs, creative programs, unforeseen challenges, and visionary projects.

Women and philanthropy: Four insights to inform your practice

At YouthBridge Community Foundation of Greater St. Louis, we’re honored to work with hundreds of individuals, families, and businesses who support a wide range of charitable causes. The generosity and commitment across generations and demographics inspire our team every single day. March is an especially … More →

Documentation is no joke and coffee is not milk: Two important tax rulings

At YouthBridge Community Foundation, we value the role you play in helping individuals and families make the most of their charitable giving. That’s why we’re committed to providing regular updates on legal and policy developments that may impact your clients. In two recent rulings, the … More →

Case study: Business owners exit with a family legacy

As an attorney, CPA, or financial advisor, you probably work with several clients who own a family business. You’ve likely also considered that there may be a role for strategic philanthropy in family business succession planning to help clients get ready for an eventual exit. … More →

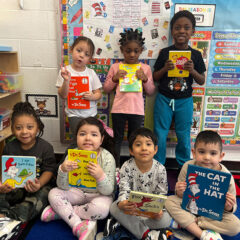

Agency Fundholder Spotlight: Cornerstone Center for Early Learning

YouthBridge Community Foundation of Greater St. Louis offers endowment building services to help nonprofit agencies generate long-term income. YouthBridge provides access to low-cost, high-quality investment solutions and endowment education, as well as assistance with the entire process that ranges from establishing an endowment fund to … More →

View all News →